Welcome to

Femme Money

Blog

hey there!

Looking for something?

on the blog

the latest post

As 2021 comes to an end, we get excited about celebrating the holidays with our friends and family. Many of us did not get to do it last year, so this holiday season feels a bit more special. It’s natural to think about Christmas parties and family vacations. But it’s also a great time to […]

Featured Story

Post Index

As 2021 comes to an end, we get excited about celebrating the holidays with our friends and family. Many of us did not get to do it last year, so this holiday season feels a bit more special. It’s natural to think about Christmas parties and family vacations. But it’s also a great time to […]

Choosing between paying down debt or investing is a balancing act. I’m sure you’ve heard something like this before: “Compare the interest rate on your debt with an expected return from your investments and put your money towards the option with a higher rate.” This money advice makes sense in theory, but there are more […]

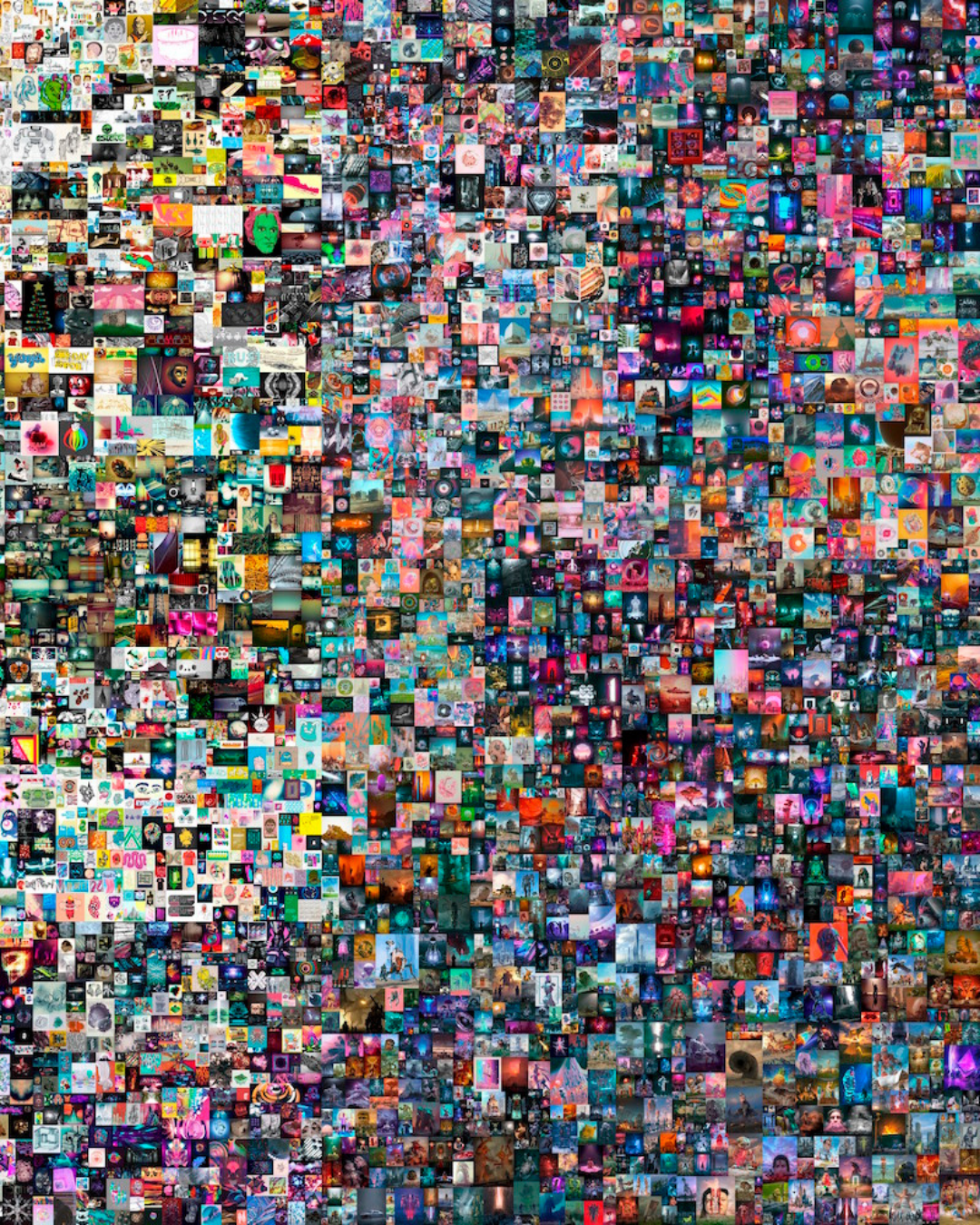

Just a couple of months ago an idea of buying and selling crypto art using NFTs (non-fungible tokens) seemed ridiculous. But NFT has recently become a buzzword. Many celebrities from Snoop Dogg to Paris Hilton have embraced it and made millions along the way. NFT is a type of digital asset that is selling much […]

If you have ever wished for a robot to do the dishes or pack school lunches in the morning, you are going to like the concept of Robo-investing. Even though Robo-advisors are not new to the market (the first one was launched in 2008), very few people understand how robos work and the benefits of […]

If you are one of 9.6 million self-employed Americans, you have four great options to save for retirement: an IRA, a solo 401(k), a SEP IRA, and a SIMPLE IRA. If all this sounds like gibberish to you right now, don’t worry. This post will go over everything you need to know to pick the […]

It’s summertime, and my boys are just like most kids – all they want to do is play sports or splash in the pool. However, I know they are happy to sit down with me and pay close attention for 10 minutes a month, even in the heat of the summer. It’s when we go […]

Teaching kids about money and investing from a young age is one of the best things parents can do. Think about it. Time is a key ingredient to investment success because you let the magic of compound interest do its work and build wealth for you. Kids have time! Warren Buffett says that the biggest […]

Let’s talk about cleansing. Not the type where you drink kale juice for three days and walk around grumpy. I’m talking about a unique benefit of investing in index funds – its ability to self-cleanse. What is an index Let me explain. An index fund tracks the performance of a specific index. An index measures […]

Let’s talk about the most important decision you are going to make as an investor – choosing your asset allocation. Your investing journey should start with identifying your goals, investment horizon, and level of risk you can tolerate and still sleep well at night. The next step is deciding on your asset allocation. Think of […]

5 Timeless Principle For Successful Long-Term Investing

Get Your Free Copy and Level Up Your Money Game

Guide

free guide

to Investing

The Ultimate

We do not share your email and don't worry, you can unsubscribe at any time :)

By clicking "sign me up," you agree to receive emails from femme money and accept our web terms of use and privacy policy.

Welcome to our VIN (Very Important Nomads!) List where see you in your box!