Just a couple of months ago an idea of buying and selling crypto art using NFTs (non-fungible tokens) seemed ridiculous. But NFT has recently become a buzzword. Many celebrities from Snoop Dogg to Paris Hilton have embraced it and made millions along the way.

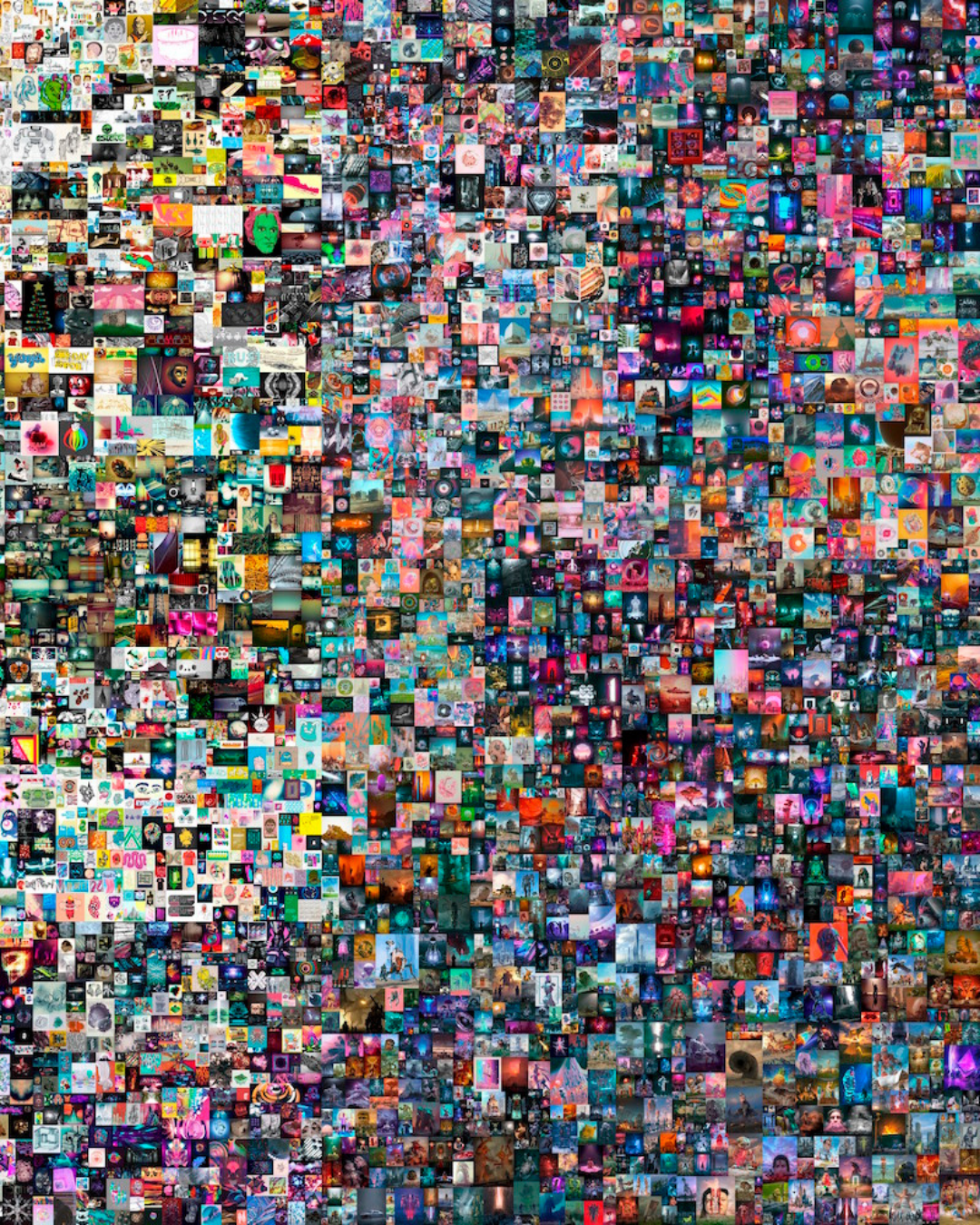

NFT is a type of digital asset that is selling much like the 17-th century Dutch tulips – some go for millions of dollars. For example, in March 2021 Christie’s auctioned off a digital collage of images called “Everyday’s – The First 5000 Days” for a jaw-dropping $69.3 million. By the way, you can enjoy this image above for free.

So, what is an NFT and why is the world going mad paying all kinds of money for it? Could it be a new investable asset class or is it just another bubble because there is so much liquidity in the markets? Let’s break it down.

What is an NFT?

A non-fungible token or NFT is a digital certificate of authenticity that is linked to a digital asset, such as a video clip, audio, an image, or an in-game item.

Each NFT is unique, hence the name “non-fungible”. Think of it as a one-of-a-kind original painting, but in a digital form.

The ownership of NFTs is recorded in the decentralized digital ledger called blockchain, therefore it’s almost impossible to steal them.

NFTs are usually bought and sold using cryptocurrencies.

Examples of NFTs by celebrities

Ellen DeGeneres auctioned her explanation of NFTs as well as a physically drawn picture of a cat that was featured in the clip for $33,495. She donated the proceeds to the World Central Kitchen.

Paris Hilton’s drawing of her cat was sold for $17,000 as an Ethereum NFT.

Jack Dorsey, CEO of Twitter and Square, auctioned his first tweet as an NFT earlier this year. His tweet simply said “just setting up my twttr” and it sold for $2.9 million.

Should NFTs be a part of your investment portfolio?

Let’s go back to the main question – are NFTs a big fat asset bubble or should they be a part of your investment portfolio?

Nobody really knows. But I believe that investing in NFTs at this point is a highly risky activity. NFTs are speculative assets, therefore you are running a risk of losing ALL your money.

Much like cryptocurrencies, NFTs don’t produce any cash flow (compared to a building you rent out or a company that has revenues) and are valued entirely based on what is someone else is willing to pay for it.

I personally am not going to invest in NFTs because of the significant risk they carry. I’ve already invested 1% of my portfolio into Bitcoin and that’s about as much mad money as I’m willing to lose.

The bigger picture

Instead of chasing the latest investment fad, I would rather focus on the things I can control, such as being clear on my investment goals, developing an appropriate asset allocation using low-cost broad market index funds, minimizing fees and taxes, and sticking to my strategy over the long term, through ups and downs of the stock market.

Discover 5 Timeless Principles for Long-Term Investing Success and Take Control of Your Financial Future – Download our Ultimate Guide to Investing below:

Found in

nft