“An investment in knowledge pays the best dividend” – Ben Franklin.

I don’t need to explain that reading a good financial book is worth it. Nothing beats picking up an old-fashioned book to dig deeper into a money topic. A study of 1200 world’s wealthiest people (including Bill Gates and Warren Buffett) found they all have one pastime in common – they self-educate by reading.

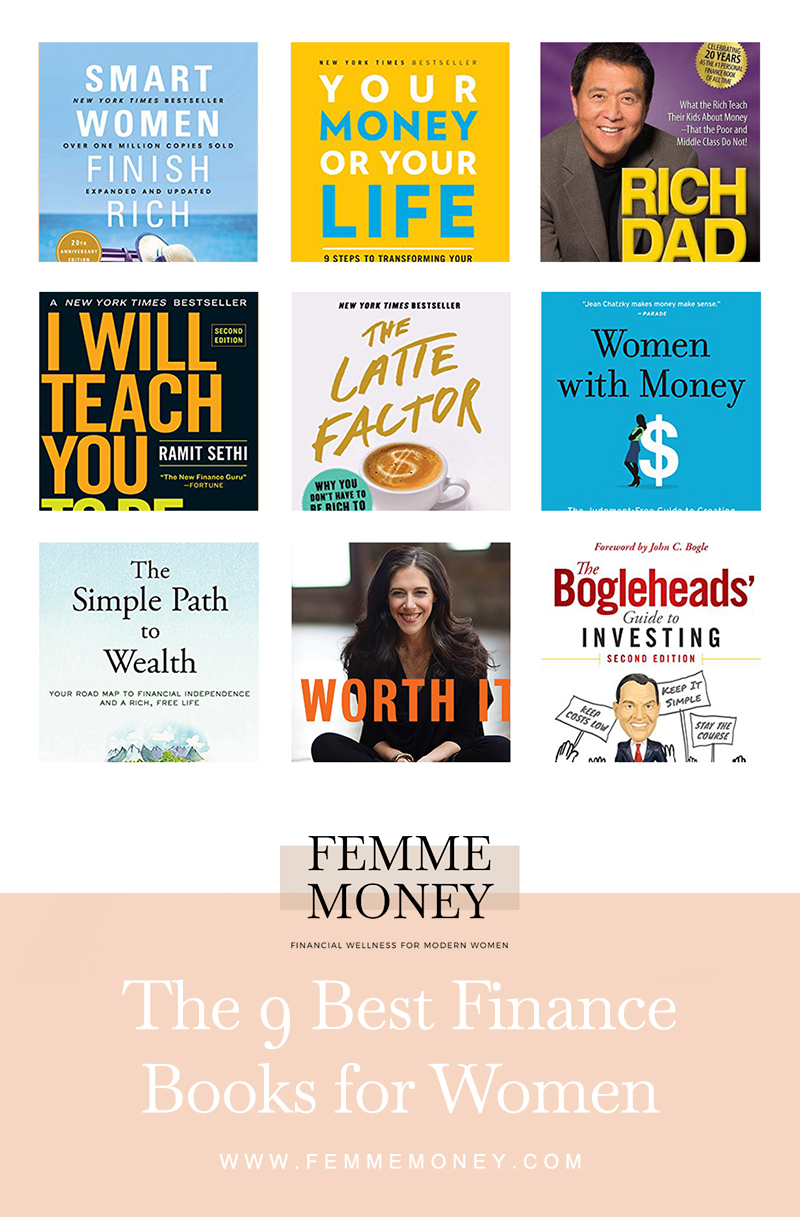

There are so many books on finance and investing out there, it’s easy to get overwhelmed. If you’d like to educate yourself on a subject of money, but not sure which book to pick, you are in luck. I’ve compiled a list of the top 9 finance books for women that will give you the knowledge and confidence boost to start improving your finances today. Happy reading!

Smart Women Finish Rich by David Bach

This million-copy New York Times best-seller is one of my favorite financial books for women. It lays out an easy-to-follow roadmap to reaching financial independence and living a purposeful life.

Whether you’re just getting started in your investment life, looking to manage your money yourself or work with a financial advisor, this book is your step-by-step guide towards reaching your money goals while staying true to your values.

David Bach is an excellent money coach and he has helped millions of women for over two decades be smarter with their money. This book is written in a jargon-free, non-intimidating manner and is perfect for finance newbies.

Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence by Vicki Robin and Joe Dominguez

This book is different from other finance books. Rather than focusing on numbers and practical steps, it homes in on your values and the way you think about money. The authors of Your Money or Your Life lay out a 9 steps plan to become financially independent by reducing spending and investing in assets that grow income. Very simple.

Financial tactics suggested in this book are quite vague and simplistic, in my opinion. However, its overarching philosophy shifted my mindset about money. It made me think about what I valued in life and realize that how I spend my money is tied to what I value. Connecting your values with your money practically eliminates the need for strict budgeting. We can all agree that budgeting is a neat concept in theory but is very hard to stick to in real life.

In today’s world of consumerism and “more is better” attitudes, we are constantly running a never-ending race of acquiring more stuff. This book discusses the refreshing concept of having “enough” and being happy and content with what you have.

Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not! by Robert Kiyosaki

Robert Kiyosaki has challenged and changed the way tens of millions of people around the world think about money.

Rich Dad Poor Dad is Robert’s story of growing up with two dads — his real father (poor dad) and the father of his best friend, his rich dad — and the ways in which both men shaped his thoughts about money and investing. The book explodes the myth that you need to earn a high income to be rich and explains the difference between working for money and having your money work for you.

Grow your assets, not liabilities. Create passive income to cover your living expenses to be financially free. Keep learning and educating yourself. Teach your kids about money. These ideas are simple but revolutionary for one’s financial success.

I Will Teach You To Be Rich by Ramit Sethi

This easy-to-read and highly actionable book outlines a 6-week plan to living your “rich life”. It shows you how to crush your debt, set up high-interest bank accounts, implement a set-it-and-forget-it investment strategy, handle buying a car or a house, exact scripts to negotiate a raise at work or talk your way out of late fees.

My favorite part of the program is putting systems into place so that managing your money is automatic. You only need to get a couple of major things right to be financially secure. Automating your finances is the biggest one of them.

The Latte Factor: Why You Don’t Have to Be Rich to Live Rich by David Bach

Another New-York Times bestseller from David Bach. The Latte Factor is an engaging and easy-to-read story that can be devoured in one afternoon.

The author talks about three simple steps to financial freedom:

- pay yourself first

- don’t budget, make it automatic

- not just money rich, life rich…

The main idea of the Latte Factor is that you truly don’t need to be rich to start investing and go for your dreams. It’s never too late to turn your finances around. I think a lot of women need to hear this message right now. Anyone can make small changes today that will have a big impact on their life in the future.

Women with Money: The Judgment-Free Guide to Creating the Joyful, Less Stressed, Purposeful (and, Yes, Rich) Life You Deserve by Jean Chatzky

Women with Money explores the fact that money is very emotional – it’s tied to our well-being, self-worth, and social circles. The book lays out a 3-part plan to the financial future you deserve:

- explore your relationships with money

- take control of your money

- use your money to create the life you

Women With Money shows readers how to wrap their hands around tactical solutions to get paid what they deserve, become inspired to start businesses, invest for tomorrow, make their money last, and then use that money to foster secure relationships, raise independent and confident children, send those kids to college, care for their aging parents, and leave a legacy.

The Simple Path to Wealth: Your road map to financial independence and a rich, free life by JL Collins

This book grew out of a series of letters to JL Collins’ daughter explaining various money and investing topics. The author acknowledges the fact that most people don’t want to spend much time thinking about or managing their money. He believes that investing doesn’t have to be complicated. Complex investments exist only to profit those who create and sell them.

This book offers an investment approach that’s not only simple to understand and implement, but also is more powerful than any other method, according to JL Collins. A couple of key points:

- Spend less than you earn, invest the surplus, avoid debt

- The greater percent of your income you save and invest, the sooner you will have F-You Money

- When you can live on 4% of your investments per year, you are financially independent.

I agree with the author that investing shouldn’t be complicated. If you do a couple of fundamental things right, you’ll do better than the majority of the people. This book is a solid no-nonsense read to get you more confident in investing.

Worth It: Your Life, Your Money, Your Terms by Amanda Steinberg

This book is about the complicated relationship between money, self-worth, and women. It encourages you to view money as a source of personal power and freedom. Money is a tool that will allow you to live life on your own terms.

The author shares her personal journey from being stuck in an unhappy marriage, a job she was tired of, and a bigger house than she could afford (like so many “rich” in America living paycheck to paycheck) to becoming an independent woman in control of her life and money.

Steinberg’s powerful and encouraging advice can help women of any age and income view money as a source of freedom and independence—and create bright financial futures.

She puts her savings account ahead of social expectations, and her investment account ahead of more clothes. Her plan for a strong financial foundation is the emergency fund first, debt second, retirement third, investments fourth.

The Bogleheads’ Guide to Investing by Taylor Larimore and Mel Lindauer

This book is a DIY investment guide reflecting the wisdom of John Bogle – the founder of Vanguard and index fund investing. Investing can be simple, but it’s certainly not simplistic. I’m a strong believer in broad-market, low-cost index fund investing – the most rock-solid philosophy for long-term investing.

You’ll learn how to craft your own investment strategy using the Bogle-proven methods that have worked for thousands of investors, and how to:

- Choose a sound financial lifestyle and diversify your portfolio

- Start early, invest regularly, and know what you’re buying

- Preserve your buying power, keeping costs and taxes low

- Throw out the “good” advice promoted by Wall Street that leads to investment failure

The hardest part of implementing this common-sense investing approach is sticking to it. No matter what happens, stick to your program. It’s the most important single piece of investment wisdom, according to the authors.

Found in

finance books for women